Bundled Payment Models: How they are Driving Value-Based Care and the Need to Embrace Them

The US healthcare reimbursement system has endured endless modifications in an effort to reduce its overall cost. As part of an ambitious shift from “volume to value,” several new programs – such as accountable care organizations – have been tested, and have demonstrated mixed results. The bundled payment model, however, has the potential to fundamentally change the way healthcare payments are made, and is increasingly being adopted by influential providers. Although CMS announced that it will make its mandatory bundled payment program optional, the private sector has been quickly moving ahead on bundled payment initiatives (1). Bundled payments have the potential to not only transform the reimbursement system, but also several areas of regulatory and transactional law, liability, and even information technology. Provider groups that are already, or are preparing to become, the leaders (“Bundlers”) of a bundled payment model stand to become the biggest winners under a value-based care system.

Reimbursement

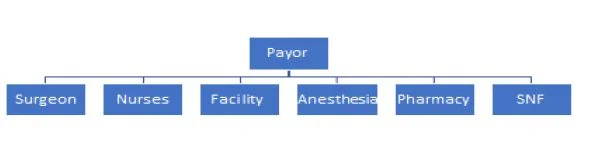

The current fee-for-service (“FFS”) healthcare reimbursement structure is set up so that a patient’s health insurance company (“Payor”) must pay, separately, every entity that provides a service to that patient. Thus, for any given diagnosis, a payor might need to negotiate with several parties. Payors generally have more negotiating power than each provider, but are too far removed from the patients to understand the nuances of treatments offered. This creates tension between payers and the providers who want to maximize reimbursements from them.

Fee For Service:

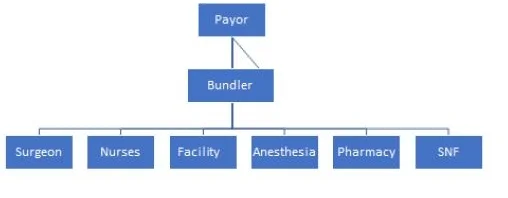

In their purest form, bundled payments redesign reimbursements so that the provider with the most control over the course of treatment for a patient is paid from the payor one lump sum, which is then distributed among preferred partners that meet quality and outcome expectations for shared patients. Providers that consistently deliver efficient care with excellent outcomes can drive down costs and increase financial savings. Alas, profits are aligned with optimal care and reward the Bundler, who has the most control over achieving it.

Bundled Payments:

Control

The ideal bundled payment model provides ultimate control to the providers: A provider group or hospital takes a single payment for an entire episode of care. For example, rather than an orthopedic surgeon receiving reimbursement only to perform a total hip replacement surgery, his group would receive one lump sum for the entire continuum of care associated with that surgery – from the facility fee, to the nurses, to the anesthesiologists, to the rehabilitation centers. If the total costs exceed the lump sum, the orthopedic group suffers a financial loss. If it is less, the group realizes these profits that would otherwise have been unavailable without the bundle.

(Note: In today’s practice, the orthopedic group does not yet receive one payment and distribute it to the other care providers. The group instead assumes the financial risk and upside gains based on a retroactive look at the overall average costs. Advanced groups are already using prospective models. The speed and interest in bundled payments is indicative that this ideal state is not far away.)

As the Bundler, the orthopedic group negotiates with all the providers along the continuum of care. The negotiation is simple: In our preferred partnership arrangement, you agree to care for shared patients, understanding the focus on improving outcomes and driving down costs. The providers that continue to deliver positive outcomes and drive down costs will continue to be preferred partners. The shared partnership drives the appeal, and can result in an increase in market share among the providers who achieve their set goals.

Fee for service

The fee-for-service model has long been criticized as one that promotes extraneous tests and referrals (2). With no financial stake in the cost of care, physicians can order a battery of tests and procedures without financial accountability. Indeed, practicing “defensive medicine” is an effective strategy by providers to reduce exposure to negligence claims.

Critics argue that bundled payments create incentives for providers to lower the quality of care in order to lower costs. This is counter-intuitive to how bundled payments are designed though, thus the brilliance of the design.

Lower quality care can result in higher complication rates and readmission’s, driving up costs and reducing the opportunity for financial savings. Thus, providers who have a financial stake in the cost of care must be judicious with their referrals and find innovative treatments and partnerships to drive quality care while reducing costs (3).

Evidence of this phenomenon emerged in the 1980’s with Diagnostic Related Group payments (DRGs) (4).“With DRG payments, which are adjusted based on a patient’s diagnosis and comorbidities, hospitals were given a single prospective per-discharge payment that bundled all of a facility’s costs, including room and board, nursing, and costs associated with specialized care and ancillary services.” (5) A study conducted in 1989 found that – after adjustment – spending in both Medicare and length of stay declined, yet there was no decline in quality outcomes (as defined by mortality and readmissions.)

More recent studies have demonstrated similar results in the current bundled payment models. In a study conducted from July of 2008 to June of 2015 following 3,942 patients in the Medicare Comprehensive Care for Joint Replacement (CJR) bundled payment program, hospitals saw an average reduction of 20.8% or $5,577 per episode (6). Readmissions dropped 1.4% and emergency room visits dropped .9%. (7) (Notably, 48.8% of the savings in the bundle occurred in post-acute care facilities.) (8)

Limitations of Bundled Payments

Bundled payments have limitations, especially in the early stages of implementation. Preventative care services and lower cost procedures might not provide enough incentive for bundling, while other more complicated conditions, such as certain chronic illnesses, are hard to define tightly enough for a practical bundle. (9)

While the risk of providing unnecessary care should be reduced with bundles, there is still the risk of initiating unnecessary episodes of care as part of a bundled contract (over-diagnosing a condition). (10)

Finally, and perhaps most concerning, is the possibility that providers will avoid patients deemed to be most high risk. (11) This is why risk adjustment measures are critical.

Bundled Payments Augment Existing “Never Events” Program

A successful effort by CMS to address what it believed were misaligned incentives was known as the “never event” program. Under this program, hospitals would no longer be reimbursed for care provided to treat any one of several enumerated conditions (such as a “hospital acquired infection”) believed to be “preventable” while treating other conditions.

Realizing that they would not only lose the reimbursements associated with treating never events, but also absorb the cost of remedial care, hospitals were forced to react. Never events, such as infections, have been on the decline ever since. (12)

The bundled payment model places a similar risk on providers to deliver cost-effective care, without complication. The model also rewards those who reduce “never events” successfully – creating an unprecedented opportunity for Bundlers.

Overlapping Models Bring Opportunity

Expanding the “Episodes of Care”

Of the 48 specialties tested by CMS under its Bundled Payment Program, orthopedics has become the most popular and successful. Orthopedic bundles have therefore been the main focus for the private payor sector.

As lessons are learned and success stories mount, providers and payors alike seek to expand to more procedures and more specialties, such as oncology and cardiology. Obstetrics and numerous more specialties will likely follow closely behind. The sooner provider groups build out a platform and develop the ability to become the Bundlers, the better positioned they will be to capitalize on value-based care.

Plugging into Population Health

Though ACOs have had a checkered beginning, similar, but more flexible, “shared savings” programs have become increasingly prevalent in healthcare – particularly among large primary care groups/ clinically integrated networks (CINs). Most shared-saving programs reward primary care groups that can lower the total healthcare spend for their patients, who are known as “attributed lives.” (13)

If primary care groups partner with specialists who run bundled payment programs, it can lead to almost guaranteed savings (see stop-loss below) under a shared-savings program – resulting in more profits to distribute. Bundlers should, therefore, gain an advantage when seeking to work in CINs.

Managing Risk

Stop Loss

Insurance known as “stop-loss” coverage can help Bundlers hedge their risk (14). By paying a per case fee, Bundlers can secure coverage for medical expenses beyond an amount set in the insurance contract. If done properly, Bundlers can negotiate considerable upside gains, while protecting downside risks through stop-loss insurance. Creating a process to handle complications should ultimately produce better outcomes, higher profits, and even reduce exposure to medical malpractice claims.

Medical Malpractice

Medical malpractice cases are filed because patients want to be compensated for damages associated with complications from medical treatment or procedures. The core of these “damages” are the medical expenses associated with the adverse events. Under the bundled payment model, the Bundlers are already financially responsible for the treatment necessary to address complications. Moreover, they can insure against its cost by purchasing stop-loss coverage.

Damages are not limited to medical expenses of course, as loss of wages and pain and suffering can be substantial. But sound risk management strategies and early intervention can significantly mitigate damages – both economic and non-economic and help prevent medical malpractice lawsuits.

Stop loss insurance combined with best-in-class risk management techniques should reduce both risk and medical malpractice insurance premiums. “Professional liability” risk folds neatly into the bundled payment “financial” risk model.

Risk Management Partnerships

Risk managers face the challenge of how to assess the risk profile of providers and then incorporate best practice risk strategies into their healthcare delivery practices. Much, if not all, of this work tends to be retrospective in nature, such as root cause analyses or chart reviews. By the time this information is reviewed, it may be (or, by definition, is) too late to prevent adverse events and resulting litigation.

Bundlers that can build a system to receive in near “real time” two critical pieces of information can gain distinct risk management advantages:

- Estimated clinical cost data: By discovering, through complex algorithms, that patients have characteristics of complications – such as an ER visit or prolonged stay at a skilled nursing facility – risk management teams can be deployed to reduce complications and mitigate damages.

- Patient experience data: Analyzing patient experience scores can be an “early warning” system that reveals when providers may be experiencing personal issues impacting their care or even burnout. Professional risk managers can help providers and patients by intervening prior to a sentinel event occurring.

Bundled payment models make it easy to justify the expense of setting these systems in place. Basic financial forecasting can demonstrate the patient care and financial benefits of having such data readily available.

The Beginning of the End of Stark and Kickback?

Assuming healthcare will one day reach a point where providers are accountable for every dollar spent on healthcare, regulations designed to prevent “unnecessary” tests and/ or referrals would no longer be relevant. Theoretically, there would be no financial incentive to “self-refer” – or make a referral to generate a kickback – if set fees are distributed per a formula and overseen by a trusted committee of peers.

Though this will not happen overnight, embracing value-based care models, and creating transparency within the process, can reduce exposure to confusing and chilling referral laws.

Billing Errors and Omissions

The provider community has fallen victim to aggressive contractors hired by payers to identify “waste” in the system. Contractors use sophisticated software to flag “outliers” and then commence audits to recover whatever charges are unilaterally deemed to be improper. Providers are forced to hire consultants and attorneys to challenge these contractors and justify the charges. Purchasing insurance for such matters is the norm.

Fixed payment models change the landscape for reimbursement and would obviate the need for the punitive audit process.

To be sure, disputes may persist with bundled payments but would center less on coding practices than on data credibility and scope of responsibility. For example, payors and providers might argue over who is responsible to pay for the medical care for a patient who goes hiking shortly after a total hip replacement and lands in the ER, a child born from a mother addicted to drugs during pregnancy or even a patient who has smoking-related complications during a surgery.

While value-based care models may not eliminate such “subrogation” issues, Bundlers should be better insulated from auditors and better equipped to resolve disputes.

Enterprise Risk

Historically, payment risk has been treated separately from liability risk. By viewing risk globally though, providers can consolidate resources and analyze problems using a systems approach. Quality assurance committees can interface with data analytics teams and utilization review experts to develop care paths that solve the most prized equation in healthcare: How to provide better care at a lower cost (Value = Quality/ Cost, or V=Q/C).

Bundled payments and the right data platforms can tie seemingly disconnected risks together, and help guide the creation of an efficient, coordinated, enterprise-wide approach to managing them.

Captives/ Self-Insurance

To this day, some medical malpractice insurance companies underwrite physicians based on a few factors such as specialty and years in practice. Whether they have a robust risk management infrastructure or even a history of being sued can play little or no role in pricing. Even the more sophisticated companies lack the means to take a deeper dive into a group’s risk profile when determining insurance premiums.

Because reimbursement risk-sharing so closely aligns with liability risk-sharing, Bundlers can realize the fruits of their care coordination efforts beyond shared-savings. By setting up proper self-insurance structures, groups can benefit financially from practicing safer medicine, and further align all interests within their practices and along the entire continuum of care.

Successful captives also create the flexibility to invest in risk management resources specifically tailored for their insureds to further improve patient care and realize greater financial gains.

Implementing Successful Bundled Payment Programs

Technology and Analytics

Most electronic health record (EHR) systems are not equipped to handle the scope and intricacies of the bundled payment model. Even systems developed specifically for bundled payments and the entire episodes of care too often do not focus on post-acute care.

A platform that tracks the entire continuum of care for a patient in a bundled payment is essential to the success in the model. This platform should be EHR agnostic and augment existing processes. This platform should also be equally accessible to all members of the patient care team.

Metrics

A key to successfully managing post-acute care is engaging the right provider partners. Ideally, all providers along a continuum of care will be on the single data-sharing platform and agree to the same set of rules to achieve optimal treatment and care coordination. While this perfect scenario might not be practical in the current environment, utilizing benchmarks and metrics can help coordinate an effective bundled payment approach.

Selecting the metrics each party is responsible to meet sets expectations and helps eliminate surprises. Keeping all parties aware of the scoreboard, but, more importantly, the metrics behind the scoring, helps everyone understand how to hit agreed upon benchmarks. Transparency breeds trust and strong partnerships, which leads to improved care at a lower cost.

Partnerships

Another key to successful execution is selecting the right partners. Careful attention and due diligence is needed to select all the following:

– An analytics and post-acute care system

– An internal management team

– Outside consultants/ Management services organization (MSO)

– Healthcare attorneys who can navigate the complex shared-savings contracting world

– Enterprise risk specialists who understand the connection between financial risk and liability

– Providers with whom to partner (or joint venture)

Conclusion

When the Affordable Care Act was first passed, experts focused on the gradual release of responsibility under value-based care. Time will reveal who stands to gain the most as the transition to value accelerates. All indications now suggest that the groups who embrace and lead the way as the Bundlers will emerge as the biggest winners.

Katherine Kuzmeskas, MPH is the founder and CEO of Simply Vital Health. Brian Kern, JD is an investor and Advisory Council Member of Simply Vital Health, as well as the founder of Toro Risk Consulting Group, LLC. He is also Of Counsel for Frier Levitt, LLC, a boutique health law firm.

References:

1. Centers for Medicare and Medicaid Services.“42 CFR Parts 510 and 512,” Department of Health and Human Services.https://downloads.cms.gov/files/cmmi/epm-finalrule.pdf (accessed November 5th, 2017).

Belliveau Jacqueline, “Private Sector to Drive Bundled Payments After CMS Cancellations.” Revcycleintelligence.com, August 23, 2017 https://revcycleintelligence.com/news/private-sector-to-drive-bundled-payments-after-cms-cancellations (accessed December 24th,2017) Gelburd Robin.“Bundled Payments And Episodes Of Care: What’s Next” Forbes, March 30, 2017

https://www.forbes.com/sites/realspin/2017/03/30/bundled-payments-and-episodes-of-care-whats-next/#58e16437e468 (accessed December 24th,2017)

Morse Susan. “Voluntary participation in bundled payment models will continue after CMS cancels mandatory initiative, experts say.” Healthcarefinancenews.com, August 16,2017 http://www.healthcarefinancenews.com/news/voluntary-participation-bundled-payment-models-will-continue-after-cms-cancels-mandatory (accessed December 24th,2017)

Meyer Harris. “Providers involved in bundled-payment programs for total joint replacement are seeing benefits.” Modernhealthcare.com, October 7,2017 http://www.modernhealthcare.com/article/20171007/NEWS/171009950 (accessed December 24th,2017)

Advisory Board Daily Briefing. “Study: Health system saves 20 percent on joint replacements under bundled payment model.” Advisory.com, January 5, 2017 https://www.advisory.com/daily-briefing/2017/01/05/bundled-payment-model (accessed December 24th,2017)

2. Robert Pearl, “Healthcare’s Dangerous Fee for Service Addiction,” Forbes, September 25th, 2017,

https://www.forbes.com/sites/robertpearl/2017/09/25/fee-for-service-addiction/#8894938c8adb, (accessed November 10, 2017).

Barnes Julie – “Moving Away From Fee-for-Service.” The Atlantic, May7,2012 https://www.theatlantic.com/health/archive/2012/05/moving-away-from-fee-for-service/256755/ (accessed December 24th,2017)

Maura Calsyn and Emily Oshima Lee – “Alternatives to Fee-for-Service Payments in Health Care.” Center for American Progress, September 18,2012 https://www.americanprogress.org/issues/healthcare/reports/2012/09/18/38320/alternatives-to-fee-for-service-payments-in-health-care/

(accessed December 24th,2017)

Ikegami Naoki -”Fee-for-service payment – an evil practice that must be stamped out?.” International Journal of Healthpolicy and Management, February 6, 2015 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4322626/ (accessed December 24th,2017)

3. Steven A. Schroeder and William Fris.“Phasing Out Fee-for-Service Payment.”New England Journal of Medicine, May 29, 2013

http://www.nejm.org/doi/full/10.1056/NEJMsb1302322#t=article(accessed December 24th,2017)

American College of Physicians. “Controlling Health Care Cost While Promoting Best Possible Health Outcomes.” 2009

https://www.acponline.org/acp_policy/policies/controlling_healthcare_costs_2009.pdf (accessed December 24th,2017)

Chernew Michael. “Let Efficient Providers Prosper.” NEJM Catalyst, December 6,2016 https://catalyst.nejm.org/health-care-payment-efficient-providers/ (accessed December 24th,2017)

Julia C. Martinez, Martha P. KingAnd Richard Cauchi. “Improving the health care system: seven state strategies.” NCSL, July, 2016

http://www.ncsl.org/Portals/1/Documents/Health/ImprovingHealthSystemsBrief16.pdf (accessed December 24th,2017)

KJ Lee MD FACS. “Here’s how to reduce healthcare costs.” Medical Economics, May 9, 2017

http://medicaleconomics.modernmedicine.com/medical-economics/news/here-s-how-reduce-healthcare-costs (accessed December 24th,2017)

4. Terry Shih, Lena Chen, Brahmajee Nallamothu. “Will Bundled Payments Change Health Care? Examiningthe The Evidence Thus Far in Cardiovascular Care,” Circulation(June 16, 2015): Volume 131, Issue 24 (accessed October 15th, 2017).

Davis Elizabeth. “Learn about Diagnostic Related Grouping and How It Works”Verywell.com, August13,2017

https://www.verywell.com/drg-101-what-is-a-drg-how-does-it-work-3916755 (accessed December 24th,2017) https://www.verywell.com/drg-101-what-is-a-drg-how-does-it-work-3916755 (accessed December 24th,2017)

Inke Mathauer and Friedrich Wittenbecher. “Hospital payment systems based on diagnosis-related groups: experiences in low- and middle-income countries.” WHO, August6,2013 http://www.who.int/bulletin/volumes/91/10/12-115931/en/ (accessed December 24th,2017)

5. Ibid. “Understanding Bundled Payments.” Harvey L. Neiman Health Policy Institute, October6,2016 http://www.neimanhpi.org/ice-t/understanding-bundled-payments/ (accessed December 24th,2017

6. Navathe AS, Troxel AB, Liao JM, Nan N, Zhu J, Zhong W, Emanuel EJ. “Cost of Joint Replacement Using Bundled Payment Models.” JAMA Intern Med. 2017;177(2):214–222.doi:10.1001/jamainternmed.2016.8263 (accessed October 16th, 2017). Amol S. Navathe, Andrea B. Troxel and Joshua M. Liao et al.”Cost of Joint Replacement Using Bundled Payment Models” The JAMA Network, February, 2017https://jamanetwork.com/journals/jamainternalmedicine/article-abstract/2594805(accessed December 24th,2017)

7. Ibid.

8. Ibid.

9. Terry Shih, Lena Chen, Brahmajee Nallamothu. “Will Bundled Payments Change Health Care?”

Chapin White, James D. Reschovsky, Amelia M. Bond. “National Institute for Health Care Reform” NIHCR: Inpatient Hospital Prices Drive Spending Variation for Episodes of Care for Privately Insured,February, 2014

http://web.archive.org/web/20160402043447/http://nihcr.org/Episode-Spending-Variation (accessed December 24th,2017)

10.Ibid.

Kenneth J. Terry, “4 Problems with Bundled Payments- How Will They Affect Your Income?, January 19,2012 https://www.medscape.com/viewarticle/756528_2 (accessed December 24th,2017)

Warrington, Thomas A., Jr., and Jennifer Brunkow. “To bundle or not to bundle?” hfma.org. November 2011. http://www.vmghealth.com/Downloads/ToBundleorNottoBundle.pdf (accessed December 24th,2017)

11. Ibid.

12. Robert Preidt, “Hospital-acquired infection rates declining,” CBS News, January 14, 2015,https://www.cbsnews.com/news/hospital-acquired-infection-rates-declining/, (accessed October 25, 2017).

11. Ibid.

12. Robert Preidt, “Hospital-acquired infection rates declining,” CBS News, January 14, 2015,https://www.cbsnews.com/news/hospital-acquired-infection-rates-declining/, (accessed October 25, 2017).

13. “Shared Savings Program: About the Program,” Centers for Medicare & Medicaid Services, https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/about.html, (accessed October 17, 2017).

Vermont Primary Source Book.”Community Health Accountable Care”January, 2015

http://www.bistatepca.org/uploads/pdf/VT%20PC%20Sourcebook/22%20CHAC%20Sourcebook%20Page%2001.2015.pdf (accessed December 24th,2017)

Morrissey John. “Whose Patient is this, Anyway?” Hospital & Health Networks, March 10,2015 https://www.hhnmag.com/articles/3650-whose-patient-is-this-anyway (accessed December 24th,2017)

14. Harvey L. Neiman Health Policy Institute. “Risk Mitigation in Bundled Payments.” October 6,2016 http://www.neimanhpi.org/ice-t/risk-mitigation-in-bundled-payments/ (accessed December 24th,2017)

Brian S. Kern, Esq., Partner, Acadia Professional.